It is also worth noting that in 2022, the average price of pellets rose from PLN 850 to around PLN 2600-2700 per tonne. This was primarily due to uncertainty in the fuel market. The price situation is currently more stable, but future trends remain uncertain, and companies need to adapt to new market conditions to maintain their position within it.

In conclusion, the Polish wood pellet industry faces challenges from import competition, regulatory changes and price fluctuations. Companies need to adapt to new market conditions to maintain their position in the market. However, everything could change if strong government support is provided for the installation of new pellet devices.

Production and consumption of pellets in Poland

.jpg)

Poland is the third largest producer of pellets, with a production of 2.2 million tonnes, almost equal to that of France. Although production in both countries is nearly comparable, Poland has almost twice as many active production facilities as France, namely 140 in 2023, with a total capacity of 2.7 million tonnes. This figure shows that, on average, Polish plants are significantly smaller in terms of production capacity. Moreover, the effects of the wood raw material crisis are being felt in Poland, with production expected to decline in 2024, with an expected capacity reduction of 200,000 tonnes.

.jpg)

In 2022 and 2023, the total wood pellet consumption in Europe declined. Indeed, as shown by the yellow line in Figure 2, consumption followed a period of steady growth between 2013 and 2021, reaching its record of 34.6 million tonnes in 2021. Consumption then declined by around 8% in 2021 and 2022 (due to an energy crisis of 2022, when pellets were in short supply, and record high prices were recorded, both resulting from the geopolitical context). In the following years, i.e. 2022 and 2023, this consumption decreased by a further 6%, dropping to a total consumption of 30 million tonnes in Europe.

.jpg)

Figure 3 shows housing consumption in markets with consumption levels ranging from 350,000 tonnes to 1 million tonnes. The figure reveals completely different trends for individual countries, making it difficult to identify any overall trend. Spain and Poland, on the other hand, have seen a steady increase in housing consumption over the last 5 years, even though the pace has been slowing down from 2021 onwards.

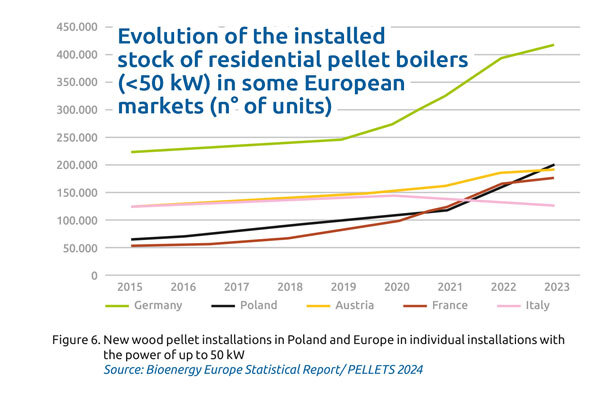

In Poland, forecasts for the development of the pellet industry show moderate optimism, both in terms of use in boilers dedicated for individual consumers and in commercial power generation. An increase in the number of pellet boiler installations in households is observed under the Clean Air Programme (in Polish: Program Czyste Powietrze). The stabilisation of pellet prices in 2024 and the growing environmental awareness of the public are contributing to an increased interest in this heating source. However, experts point to potential challenges related to the availability of the raw material, especially in the context of planned regulations restricting the burning of sawdust and woodchips for energy purposes.

Poland’s wood pellet industry faces competition from cheaper imports from the Baltic States and Ukraine and potential regulatory changes. However, growing interest in renewable energy sources and support programmes for environmentally friendly heating systems may foster further growth of the pellet market in Poland.

.jpg)

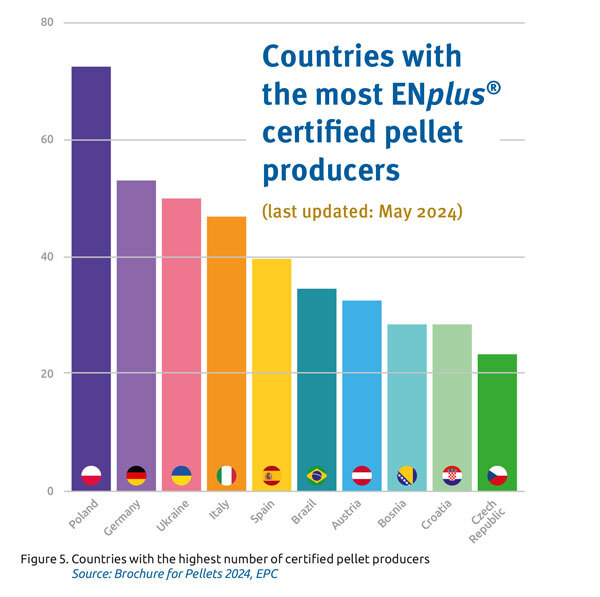

Despite the difficult geopolitical situation in the period 2022-2024, the Polish pellet industry has recorded tremendous progress - today, we are in first place in terms of the number of certified companies in the country, and we can be proud of the impressive number of ENplus® certified companies. Additionally, it should be mentioned that further modern production lines are being built. In 2024, 13 new ENplus®-certified manufacturers and 9 new ENplus®-certified trading companies were recorded, which shows lower growth than in previous years but, nevertheless, demonstrates the continuous development of this industry in Poland.

The wood pellet industry in Poland continues to see increases in pellet production, which are mainly due to new, medium-sized (up to 10,000 tonnes/year) production units. Most of them opt to obtain a certificate confirming the uniformity of pellet parameters in quality class A1 or A2, i.e. the ENplus® certificate.

Poland’s wood pellet industry needs legislation to regulate the use of wood pellets

The Ministry of Climate and Environment has introduced new quality standards for woody biomass, which could affect the availability and price of pellets on the domestic market. Experts are concerned that these regulations could limit the availability of high-quality fuels and lead to higher prices.

According to a draft ordinance published by the Ministry of Climate and Environment, quality standards for wood pellets and briquettes - both those produced in Poland and those imported from abroad (subject to customs procedures) - will be tightened. As the project’s authors emphasise, current biofuels in the form of wood pellets and briquettes are not covered by the monitoring and control system, and no legally binding quality requirements have been established in their case. The new legislation will, therefore, tighten quality requirements for the sale and, consequently, the combustion of biomass-based biofuels, i.e. wood pellets and briquettes.

In the case of wood pellets intended for boilers of energy classes 3, 4, and 5 or those that meet ecodesign requirements, the quality requirements will correspond to quality class A1 according to PN-EN ISO 17225-2, so, among other things, they will have to show a maximum acceptable ash content of up to 0.7% (and not 1.20% as in quality class A2). The Ministry of Climate and Environment emphasises that the new regulations are intended to limit the burning of solid biomass fuels with admixtures of chemically processed additives and plastics in households and heating installations with a power of up to 1 MW.

Currently, not all commercially available wood pellets and briquettes meet the quality requirements of the ISO EN 17225 of the European standards. Increasing the control over the quality of biofuels available on the market is expected to help eliminate low-quality products from the market and reduce emissions of pollutants into the environment.

The proposed amendments introduce mandatory certification, i.e. confirmation of the quality class of wood pellets by an independent third party. This means that any type of wood pellet introduced to the market and sold in Poland must meet specific quality standards for quality class A1, if it is intended for use in heating appliances of class 3, 4, and 5 and/or those meeting the requirements for ecodesign, or quality class A2 if used in heating devices rated as below emission class 3 as defined in the EN305-5 standard. Thanks to this, the users will be ensured that the biofuel they buy is of the highest quality and, thus, that it is efficient when combusted and safe for health and the environment.

Are we in danger of running out of wood pellets on the Polish market, and are owners of pellet boilers going to face a huge problem?The Polish Pellet Council predicts that the situation from two years ago should not happen again. What is more - the proposed regulation will improve the regulation of quality issues, something the whole pellet industry has been fighting for since 2017. The threat to the Polish pellet market is not the aforementioned draft regulation of the Minister of Climate and Environment but rather the lack of regulation in this area.

This is evidenced by the problem of an inflow of woody and non-woody pellets from across the eastern border into Poland (estimated at 20,000 t/month). It poses a serious challenge for domestic biofuel producers. Imported pellets, characterised by low prices, make it much more difficult for producers to remain competitive. Often, though not always, imported pellets are perceived by consumers as products of inferior quality. Nevertheless, its tempting price attracts many of them, further complicating domestic entrepreneurs’ situation by confronting them with the challenge of staying in the market. The last few months have been a time of a significant price battle for Polish producers, who have to face the low price of wood pellets coming in from across the eastern border.

The specific date for implementing the new regulations has not yet been confirmed, although the date 1.01.2025 has been mentioned several times. In the text of the draft itself, one can read that the regulation enters into force 14 days after the date of publication. However, the Ministry of Climate and Environment has announced that appropriate public consultations will precede the introduction of stricter quality requirements for wood pellets. In addition, a transitional period will be defined to allow producers and distributors to adapt to the new requirements.

The introduction of new quality regulations for wood pellets is a step towards improving air quality and protecting the environment. By tightening the requirements for biofuel, users will have access to selected, high-quality products, which will positively impact combustion efficiency, health, and environmental safety. Certification will ensure market transparency and protect consumers from purchasing low-quality fuels.

The new wood pellet legislation is a positive development that raises biofuel quality and safety standards while supporting the fight against air pollution and promoting transparency in the market.

The pellet industry, which was initially a niche industry, has become an important part of the home heating system for several years. The activities of the Polish Pellet Council have contributed to this perception of the industry.

The figure above shows consumption by individual housing installations in markets with consumption levels ranging from 350,000 tonnes to 1 million tonnes. The figure indicates different trends for particular countries, making it difficult to identify any overall trend. Spain and Poland, on the other hand, have seen a steady increase in consumption by individual housing installations over the last 5 years; however, this rate has been slowing down from 2021 onwards. Belgium has seen a lot of fluctuations that distinguish it from the downward trends in Scandinavia and the growth seen in Spain and Poland.

Regarding absolute values, Poland, which has experienced exponential growth since 2015, is the second largest country, slightly ahead of Austria in third place. This growth is mainly driven by attractive financial support programmes, primarily the Clean Air Programme, a government subsidiary programme. It offers investment support for replacing old and inefficient coal-fired boilers with a wide range of more modern installations. According to the Polish government, this programme has already subsidised the replacement of more than 700,000 heat sources, 21% of which were biomass boilers (including also biomass other than pellets). This mechanism is a straightforward means to decarbonise the residential heating sector effectively and has allowed Poland to maintain a constant figure for its annual sales, unlike any other country. Last year, the Polish market contracted by just over 5%. Sales in Italy dropped by more than 80% year-on-year. Similarly, all other markets, except Poland, saw a significant decline.

Author: Agnieszka Kędziora-Urbanowicz

President of Biocontrol Sp. z o.o., Vice-President of the Polish Pellet Council, Auditor ENplus/ DINplus/ KZR SURE/ SNS

I graduated from the Faculty of Commodity Science, specialisation: Commodity Science and Quality Management at the Maritime Academy in Gdynia. Later, I graduated from postgraduate studies in Energy Science and Renewable Energy Sources at the University of Warmia and Mazury in Olsztyn. For 10 years, I have been involved in certifying product quality and management systems. I am a long-term third-party auditor in certification bodies, i.e. Polish Centre for Research and Certification, SGS Polska Sp. z o.o., Control Union Poland Sp. z o.o., DINcertco GmbH, Bureau Veritas Polska Sp. z o.o. and DQS Polska Sp. z o.o. I am an active working committee member at the European Pellet Council (EPC) within BIOENERGY EUROPE. Currently, I am also Vice-President of the industry association, the POLISH PELLET COUNCIL.

Polish Pellet Council www.polskaradapelletu.org

The Polish Pellet Council (Polish: Polska Rada Pelletu), a National Industry Association to promote pellets, was established in 2017 as a result of a grassroots initiative of the representatives to address the needs of this thriving industry. We focus on activities that contribute to improving air quality and reducing CO2 emissions through ongoing collaboration with legislators on national regulations, promoting pellets as an environmentally friendly biofuel, and conducting research, development, and education activities. We actively support producers, traders, service companies, and end users. The Council also acts as a national point of contact for the pellet industry in Poland and abroad regarding regulations, pellet quality, certification systems, and testing. We are also involved in monitoring and fighting counterfeiting and abuse by entities impersonating certified pellets or introducing non-compliant pellets. Moreover, the Council represenṫs the pellet industry in interactions with bodies of state administration and local governments.